Brazil: The poultry sector is optimistic

By Markus Wolf, DLG Mitteilungen

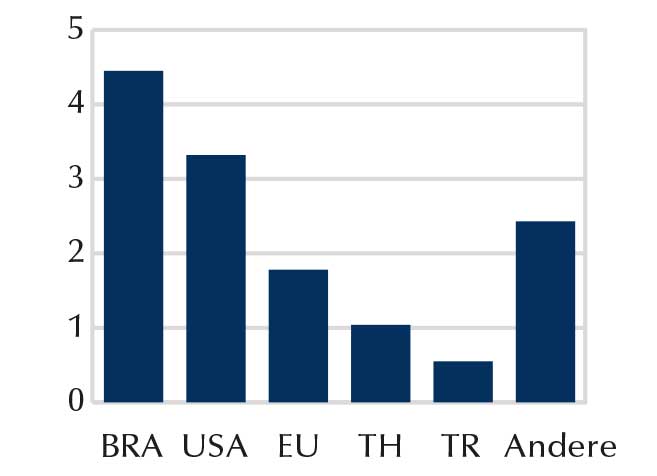

Brazil is the biggest player in the international meat market. Across the three main species of pork, beef and poultry, the South American country has a market share of a good quarter in world trade. In 2022, exports totaled around 8.7 million tonnes of meat. That was 860,000 tonnes more than the USA and 2 million tonnes more than the EU sold to third countries.

The most important trade for Brazil is poultry meat. This accounts for a good half of all meat exports. In terms of volume, Brazil has an outstanding position in poultry meat: in 2022, the South Americans sold almost 4.5 million tonnes of chicken meat abroad, as much as the EU, Thailand, Turkey, China and Ukraine put together - and they recently occupied places 3 to 7 in the ranking of the largest exporters. The USA is in second place with 3.3 million tonnes. What are the prospects for Brazilian poultry producers in 2023, who are competing for market share on the world market not only with the USA but also with the EU?

Consumption of poultry meat in Brazil recovers from the pandemic

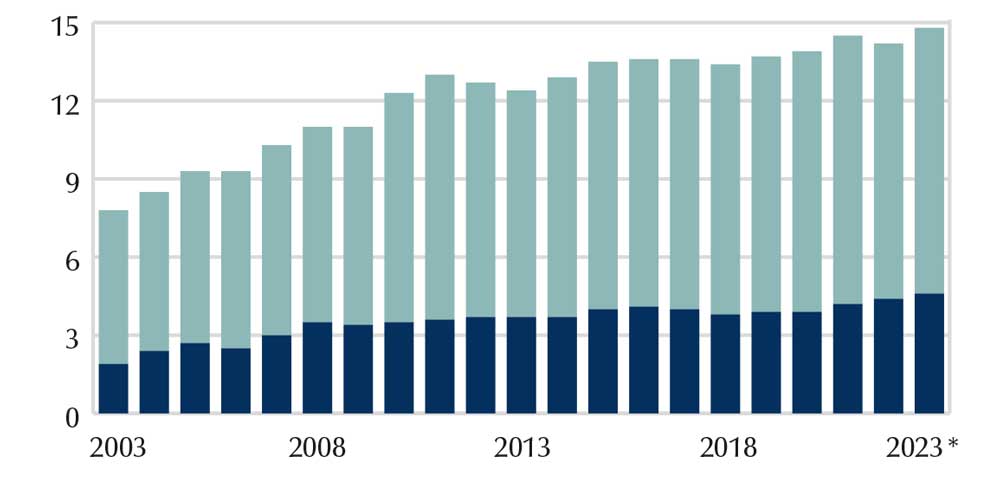

The export business represents an important part in the utilisation chain of Brazilian poultry production. About one third of the production volume ends up on the plates of consumers all over the world. However, this also means that two-thirds of the poultry meat is consumed domestically - and the trend is rising. Looking at the development of the past years, the demand in the domestic market has grown faster than the foreign business. The corona year 2022 represents a turning point: The pandemic impaired economic growth, caused unemployment figures to rise and also depressed private consumption. The result was a 2.5 % decline in poultry meat consumption, according to a recent report on Brazil's poultry market by the US Agricultural Attaché in Brasilia (the US Department of Agriculture uses a 5 % decline as a basis at this point).

For 2023, the general conditions in Brazil are more positive: the Brazilian central bank forecasts economic growth of 0.8%, President Lula da Silva wants to raise the minimum wage and increasing social spending for the poor population should boost consumption. Therefore, the US market observer in Brasilia expects domestic consumption of the most popular type of meat, poultry, to increase by 2 % in 2023, almost completely offsetting last year's decline.

The weak real strengthens the export business

In contrast to the domestic market, Brazil's foreign poultry meat business did not slump in 2022. On the contrary, the quantities marketed there even increased, by 5% to 4.4 million tonnes. The reason for this is the devaluation of the national currency, the real, against the US dollar; the exchange rate has been above the 5:1 mark since 2020 (in previous years it was between 3:1 and 4:1). As a result, poultry meat from Brazil became cheaper on the world market and more competitive compared to goods from the EU or the USA. This situation is likely to change little in the coming months, so that the US Agricultural Attaché assumes a further increase of 3% to a record high 4.6 million tonnes for the export business in 2023.

Brazil sells around 30 % of its poultry meat production abroad (Figures in million t)

* Prognosis

Great importance of China as a sales market

The most important markets for Brazilian poultry meat are China, the United Arab Emirates, Saudi Arabia and Japan. These five countries accounted for 45% of the total trade volume last year. The EU members as a whole account for another 5 to 6 % with deliveries of 200,000 to 250,000 tonnes.

Since 2014, Brazil has been the largest supplier of poultry meat to China. In 2022, the South Americans' market share of China's purchases was 43% (followed by the USA, Russia, Thailand and Argentina). At the same time, the Chinese empire is the most important market for Brazilian chicken meat exports. At last count, 47 farms were approved for export to China. Since the beginning of the corona pandemic, however, negotiations on the approval of further plants have come to a standstill.

In 2023, the Brazilians' business in China is expected to increase. This assumption is based on both the easing of corona measures in China and expected supply shortages in key competitor markets triggered by avian influenza outbreaks, lack of feed availability and/or high costs, as well as logistical difficulties.

The major poultry meat exporters

The sword of Damocles: avian influenza

Avian influenza is also a major issue in Brazil. So far, the country has not recorded an outbreak of the animal disease. However, reports on the detection of the pathogen in Argentina, Bolivia, Ecuador, Colombia, Peru, Uruguay and Venezuela have put the industry on alert. It is true that the Andes and the Amazon rainforest form a natural barrier against the introduction of the pathogen by migratory birds. Nevertheless, the government and associations are stepping up their efforts: Production facilities in the catchment area of lagoons and resting places for migratory birds are banned; hygiene measures and stock protection (for example, by covering outdoor pens) are increasingly being promoted.

And not without reason: An introduction of avian influenza into Brazil would endanger Brazilian poultry exports, as the country has not yet concluded any regionalisation agreements with its customers. If the pathogen were detected, existing trade agreements would have to be renegotiated in a lengthy process.