Commodities: Is the big bull market coming?

By Robert Theis, analyst for commodity markets at the brokerage firm StoneX in Frankfurt

Money supply - inflation - commodity bull market. This is basically how the monetary policy of the central banks in recent years has affected the prices of commodities and thus also grain, oilseeds or sugar.

First the money supply increased ...

In the first half of the 20th century, the term "inflation" was still understood by economists as the expansion of the money supply. Nowadays, inflation is understood to be the general rate of inflation, which is determined on the basis of a selection of representative baskets of goods.

The more money comes into circulation, the greater the willingness to pay. In addition to the factors that affect prices from the individual goods and services, however, there is another effect that affects prices from the side of money itself. Money is a medium of exchange that is generally accepted on the market. If it loses this property, all derived functions such as the unit of account function and the store of value function are immediately lost.

The special role of money

Money thus occupies a special position. If the money stock of individual persons or enterprises is increased, it enables them to procure scarce goods by paying higher prices. This payment increases the money stock of the sellers, who in turn are now in a position to add more money elsewhere for another good. Over time, a general inflationary effect arises from the inflation of the money supply. As a result, purchasing power falls, initially for scarce goods (such as houses in dream locations or farmland), but in the long run also for goods that are available in sufficient quantities (such as cars or bread). The important thing is who gets the "fresh" money first. If these were poor people, for example, they would probably spend it on goods and services of daily use. This would be directly reflected in the inflation rate.

In fact, however, the additional money goes via commercial banks first to those who can also offer collateral for loans. Typically, these people do not buy additional goods for their daily needs - because they already have enough - but invest. In factories and plants or, if that does not seem profitable, in valuables. Therefore, inflation forms in the first step for these goods (concrete inflation), while the purchasing power for goods and services of daily use is initially maintained.

A latent decline in the purchasing power of money is desired by many economists because borrowers are put in the position of being able to meet their past payment obligations in the future with money units that have lost purchasing power. This is said to have a growth effect on the economy. In any case, debtors benefit, but creditors and savers lose out. Unless they can compensate for this loss of purchasing power with interest income. But that is not the case at present.

... then came asset inflation

Central banks are avowedly aiming for 2% inflation, so far unsuccessfully. But just because the zero interest rate policy and the extremely expansionary monetary policy have not yet been reflected in the representative consumer goods basket does not mean that they have remained completely without impact. On the contrary: we already have inflation in assets.

The flood of money that the central banks have been pouring over the markets not only since the financial crisis of 2008 has primarily flowed into assets and created inflationary speculative bubbles there. Bonds - especially government bonds - shares, houses and land, works of art or other luxury items are at price heights that would be unthinkable without the permanent supply of money. The circle of those who can afford these things is becoming smaller and smaller.

Whenever an event occurs that wants to bring valuations back to a level that is healthier for the real economy (e.g. financial crisis), the central banks print even more money to prevent exactly that. In view of the grotesquely high debt levels, they are afraid of the price-related value adjustments that would then have to lead to balance sheet corrections. It goes so far that central banks are even buying government bonds en masse at top prices because they fear rising interest rates (refinancing costs). This would instantly make hopelessly over-indebted states insolvent. Private sources of refinancing have long since been exhausted on these scales because they rightly fear the risk involved.

A loss of purchasing power of money in the consumer goods sector is predictable

The corona pandemic is accelerating the development even further. After the bursting of the dotcom bubble at the turn of the millennium, the next cycle of loose monetary policy triggered a commodity boom and a boom in US real estate securities. The collapse of the latter provoked the financial crisis, and since then monetary expansion has reached unprecedented levels. Bond markets are at all-time highs, stock markets are booming thanks to a handful of tech stocks into which the freshly printed money is flowing, and real estate prices have exploded just about everywhere.

After the Coronacrash a year ago, it all repeated itself again in heightened potency. Individuals may still get the same amount of butter, bread and petrol for their money, but they also get far fewer shares and real estate.

And then consumer goods will be the last to suffer. At the very latest, a price increase in commodities will also provoke price increases in the basket of goods used to calculate inflation. For the foreseeable loss of purchasing power of money in the consumer goods sector, the market will demand higher interest rates and put the bond markets under pressure.

Such a development can already be observed in the 10-year US government bonds since October last year. In a short time, the 40-year bull market bred by low interest rates and money printing should come to an end. Then investors will have to decide in which assets to invest the freed-up money.

Now comes commodity price inflation

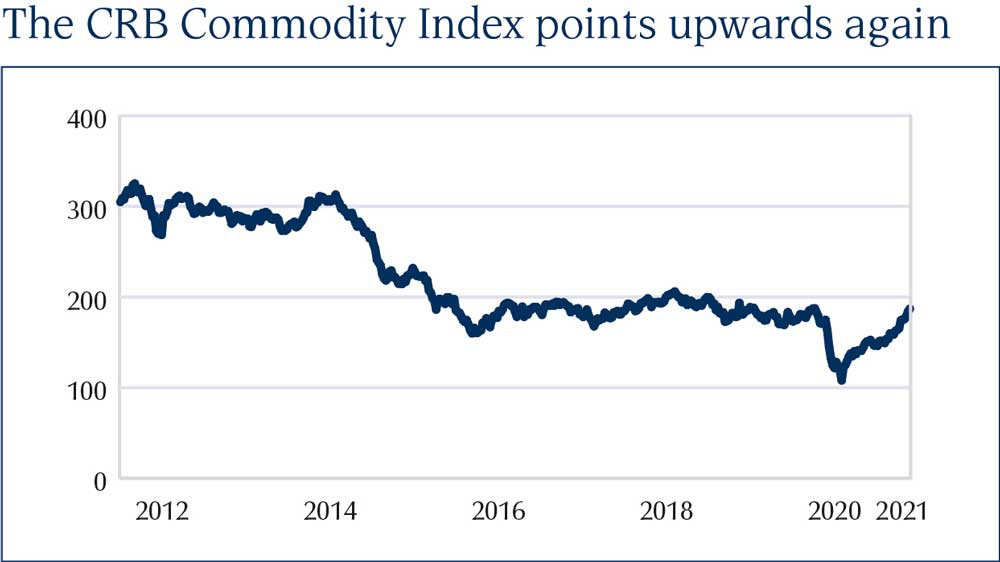

Parts of the stock markets are already massively overvalued and real estate is more expensive than ever. Therefore, it is very unlikely that money will continue to flow into these assets. Commodities, on the other hand, have been treated stepmotherly and neglected by investors for over ten years. There are still opportunities for big returns here if money flows into energy, metals or food for lack of other profitable investment opportunities.

Industrial metals are already trading at long-term highs - despite Corona. In fact, we have been seeing a steady inflow of money into this asset class for several months. Industrial metals such as copper and nickel are trading at multi-year highs. Oil prices have again reached the US$ 60 per barrel mark (see also page 96), and grain and oilseeds are currently experiencing a real boom.

A good part of these price increases, some of them very large, is certainly coming from the commodity side. Production cuts in Saudi Arabia, crop failures in China and the rebuilding of pig stocks there are tightening the market. And a real economic recovery should follow after the Corona lockdown, with a pick-up in demand for commodities in the bag.

Gold as an instrument for protection?

In the commodities segment, there is one group that stands out particularly from the scenario outlined: precious metals. Because if the demand for money declines, i.e. if one wants to get rid of one's money in anticipation of future losses in purchasing power, physical gold acquired anonymously and stored outside the banking system offers itself as an excellent investment and protection instrument. The moment gold takes the lead in the commodity bull market, there are no longer commodity-side reasons behind the price increases, but money-side ones. "The tide lifts all boats" they say. And inevitably a bull market in precious metals will pull the other commodities along with it.

However, the high nominal value achieved then will not be reflected in purchasing power, because this is correspondingly low in the inflationary price development for all goods. Owners of material assets, however, will suffer the least losses, which also includes farmers with their land. After all, those who own the basics for extracting raw materials, essentially land or mines, will benefit the most from this development.

A new factor for price setting

The monetary prices of goods and services are mainly influenced by supply and demand. However, this only ever affects the individual good or service under consideration.

Wheat, soybeans or barley are subject to special supply dynamics due to their annual production cycle. The weather (failed or record harvests) or old surplus stocks from previous years play an important role. If stocks from previous years are still abundant, the effect of a price upswing can usually be kept within narrow limits. We are reminded here of the time when intervention warehouses were full and reduced yields could be absorbed in terms of prices.

The demand for agricultural products shows relatively stable growth rates from year to year, so that one can estimate them quite reliably. The years of great price upswings are invariably those in which production has to give way due to weather conditions and supply is so tight that this makes it necessary to ration demand by increasing prices. Only when the symbolic last tonne threatens to be sold out do prices run away.

In the coming years, this mechanism could be reinforced by a shift in the money supply. If a lot of money flows into commodities for lack of other promising investment opportunities, agricultural goods will also be affected.