Cropping for starch: cardboard creates more demand

By Dr Christian Bickert

European demand for milling grain for bakery and pastry products marks time at the moment. In Germany, for instance, annual flour production has been more or less static for years with millers processing 8 million tonne (m t) wheat and 800,000 t rye. EU feed grain deliveries to mills and farm mixers have also been relatively stable long term, at between 162 and 167 m t, an insignificant variation of 5 m t.

The only big differences occur in type of grain processed, mainly concerning maize and wheat with preference shifting from year to year depending on harvest weather and prices. If we look at Germany, grain used in compound feeds has increased by around 1 m t or 5 % over the last five years.

Grain for starch

Driven by improved financial markets, demand for grain from the starch sector has shot up. Tonnages involved are really substantial: an additional 300 000 t of wheat for the Zeitz plant in Germany (when this Südzucker facility moves into top gear) and 200 000 t wheat for Austrian Pischelsdorf (Agrana) and, from 2019/20, a plus of 300 000 t wheat expected from Hamm in Germany (Jäckering), 500 000 t maize from the Szolnok plant and 400 000 t wheat for nearby Debrecen (both Hungary). With the exception of the Szolnok plant (isoglucose), all the others are aiming starch production mainly for corrugated cardboard. The plants mentioned represent an additional turnover of 1.7 m t grain and capacity increases in existing plants can be added.

Globally, too, the starch market increases exponentially: the International Grains Council reckons in 2019/20 on 138 m t of grain for starch production worldwide. Four years ago, this figure barely topped 113 m t. The majority of this tonnage is aimed at saccharification, i.e. isoglucose production.

Just under 40% of starch produced in Europe is for the non-food sector, although this processing direction is the most important influence in the current capacity expansion. Every packet ordered in the Internet drives cardboard demand further upwards, as does the packaging of machinery parts and components within industry. Market relevant for farmers in southern Germany are the plants in Austria and Hungary. Their influence reduces the tonnages of grain being shipped up the Danube towards seaboard ports, or even across borders. The grain the Hungarians process from their own farmers no longer reaches the feed mills in Bavaria, for instance. And even the grain loaded onto barges and shipped out of Hungary can be snapped-up by the starch plant in Austrian Pischelsdorf before it gets any further. Above all, this pattern reduces the amount of maize on the Bavarian market.

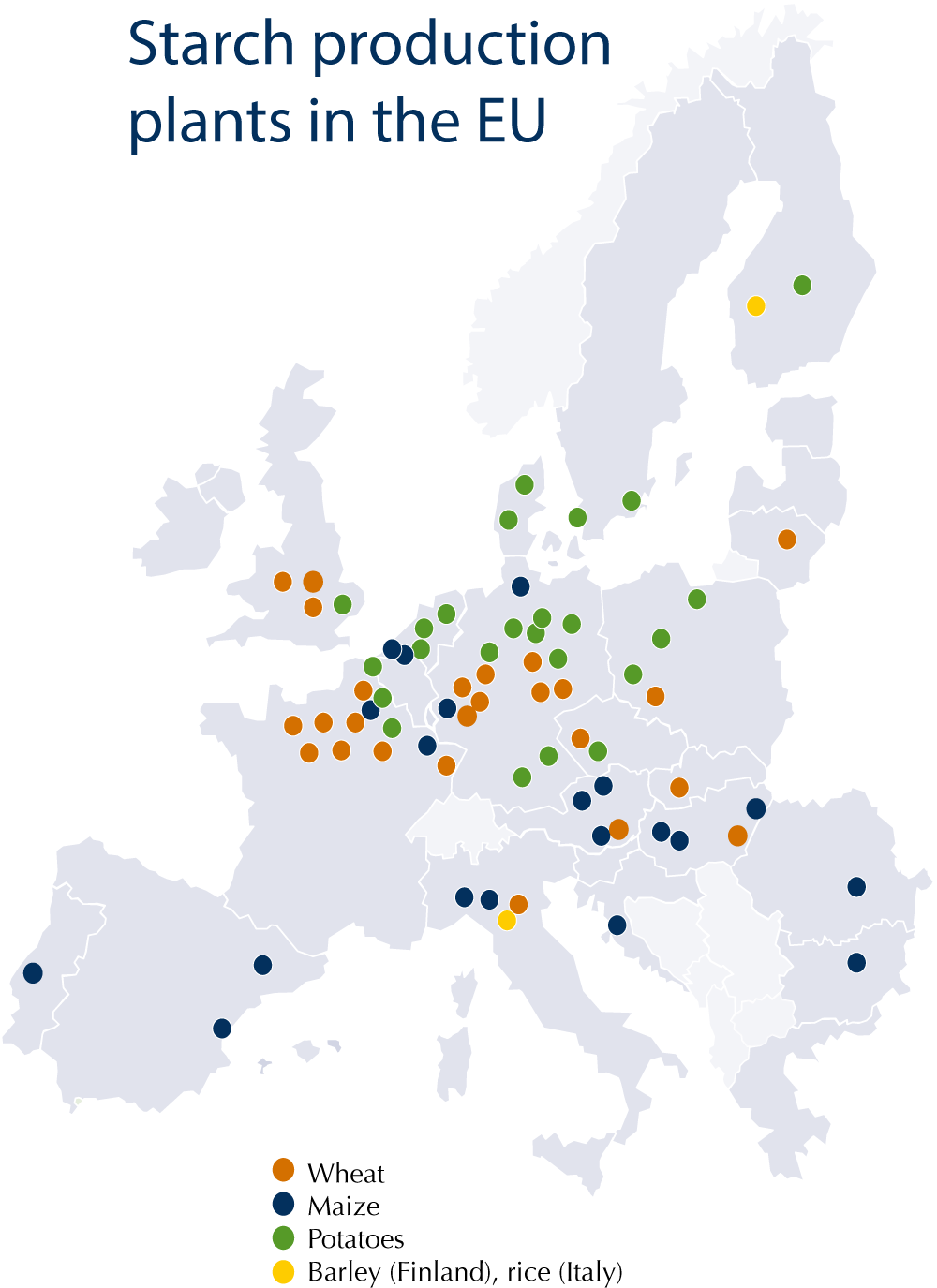

The starch plants all lie in the most important production centres for wheat, maize and potatoes. However, these are not in coastal areas – with the exception of the Dutch and Scandinavian potato processing plants. Starch is regarded as transport-sensitive and this is why, alongside nearness of suitable farmland, proximity of food and paper manufacturers is important. This explains the continued existence of starch plants in countries such as Finland where cropping climate is less than ideal.

Wheat instead of maize: by-products decide

Alongside the newly built or planned starch capacities in German Zeitz and Hamm, the Cargill plant at Krefeld is also important in this respect. This plant has long been in production, although there’s no news from the firm that it is to be expanded. What Cargill is planning, however, is a change in raw material from maize to wheat as from 2020. As far as the end product starch is concerned, no new targets or products are foreseen. It is the by-products of wheat that offer more. Maize certainly gives more starch per tonne than wheat but produces less by-product and, most importantly, less valuable by-products. Wheat by-products include proteins that can be sold-on at high prices for aquaculture feed inclusion.

Influence on wheat price

And it is especially for wheat that the growth of starch production in western and southern Europe distorts location price relationships. Even in the last two years there has been hardly any difference in wheat prices for farmers in the south or north of Germany. But in some weeks the price around south Germany inland harbours was higher than that near export harbours and this is the trend expected to increase in coming years, even in situations where export markets once again grow. The estimated 20 €/t price difference between north and south Germany could, in this respect, shrink to €10/t in the coming years. And in periods of low exports such as the just completed financial year, the additional demand from starch plants could well narrow this differential even more.