Market outlook: Poultry is the winner

By Markus Wolf, DLG Mitteilungen

2022 has turned out to be an exceptionally bad year for pork production in Germany. Up to and including August, slaughter numbers were 9 % below the previous year, which corresponded to a decline of around 3 million pigs. At the beginning of October, the gap in weekly slaughter numbers compared to the previous year was still a good 7 %. In contrast, the number of poultry slaughtered increased by about 2 % by the end of August. Consumers are therefore increasingly switching from pork steak to chicken breast as a cheaper alternative.

This pattern is currently evident not only in Germany or the EU, but all over the world. This will not change in the coming months until well after the turn of the year. At least that is what the EU Commission and the US Department of Agriculture (USDA) assume in their current outlooks for the new year.

Big loser - pig farming in Germany

Brussels expects the volume of pork in the community of states to fall by 1.2 million tonnes in 2022. Germany, the second largest producer country, will account for about half of the expected 5 % decline. However, pork production in Poland, Belgium and Italy will also shrink by 2 to 3 %. Growth, although to a much lesser extent than in the past years, is only expected for the pork industry in Spain.

For 2023, the EU Commission assumes a further decline for the member states, which will be rather moderate at around 1 %. Continuing high costs for feed and energy as well as the consequences of African swine fever (ASF) stand in the way of growth. The high production costs keep profitability under pressure and make the sector increasingly unattractive.

Inflation is reducing demand

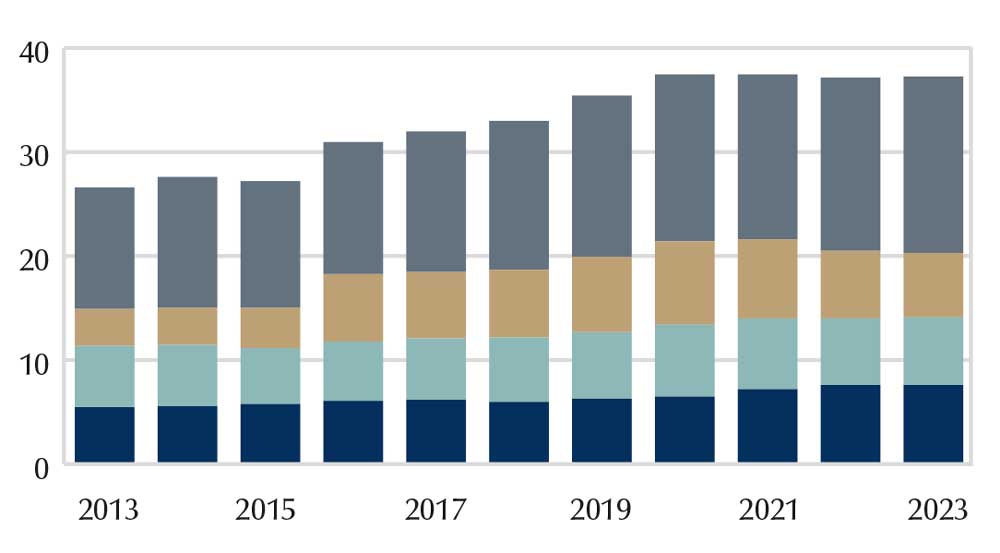

For 2022, it looks like the EU will see a decline of almost 2 % in this regard. Converted per capita, this amounts to 32 kg which is 3.5 kg less than 20 years ago. This does not include the demand effect of the approximately 4 million Ukrainians who fled the war in their home country to the EU by mid-October.

Domestic consumption is expected to remain stable in 2023. In terms of exports, the declining demand of China, the largest buyer, is making itself felt. Some of the released volumes can be redirected to other countries (mainly Japan, the Philippines, the USA, Australia and the UK). Nevertheless, the bottom line for EU exports in 2022 is a shortfall of about 800,000 t, to which a few more 100,000 t are to be added in 2023. At 3.8 million tonnes, EU pork exports will then be close to the level of before the outbreak of ASF in China, which brought the EU third-country business the record years 2019 to 2021.

Poultry production is falling while demand is rising

EU poultry production is supported by the price advantage over pork or beef. Despite the relatively high demand, the EU Commission assumes only moderate growth for some of the large producing countries (Poland, Spain and Germany) due to high production costs. There are significant declines in 2022 due to the outbreak of avian influenza in Italy, France and Hungary (together - 11 %). For the EU as a whole concept, the forecast is - 1 % for 2022 and - 0.5 % for 2023. Domestic consumption of poultry in the EU is expected to increase slightly in 2022, with per capita consumption expected to remain stable at 23.3 to 23.4 kg both this year and next.

Poultry meat has the best prospects in 2023

The USDA expects production to increase by 2 % to a record 103 million tonnes. Increases are expected for all major producers (except China), with the largest increase occurring in Brazil. Profitability is under pressure globally, but at the same time robust demand for lower-cost animal protein sources is having a positive impact. Growth in Brazil, by far the largest supplier (ahead of the EU) of poultry meat, comes from both domestic and global demand. In 2022, Brazil will also have replaced China as the world's largest producer.

The USDA also expects world trade in poultry meat to reach a new peak in 2023 (+ 4 % to 14 million tonnes). The increase will be driven primarily by rising demand in China, the EU (by almost 1 million tonnes) and Saudi Arabia. Brazil's price competitiveness, its access to the EU market and its ability to supply halal products make the South Americans the most promising candidate to meet the rising demand.

According to the USDA, China will be the driving force behind pork production in 2023. With 52 million tonnes, the values recorded in China before the ASF are within reach. Accordingly, import demand (from the perspective of EU suppliers) looks rather meagre: The forecast for Beijing's purchases is once again slightly below the 1.8 million t expected for 2022. Nevertheless, there are opportunities for EU exporters, as Japan, the UK, South Korea and the Philippines are expected to continue to buy large quantities.