Pig production in Spain: High integration and plenty space

By Christin Benecke

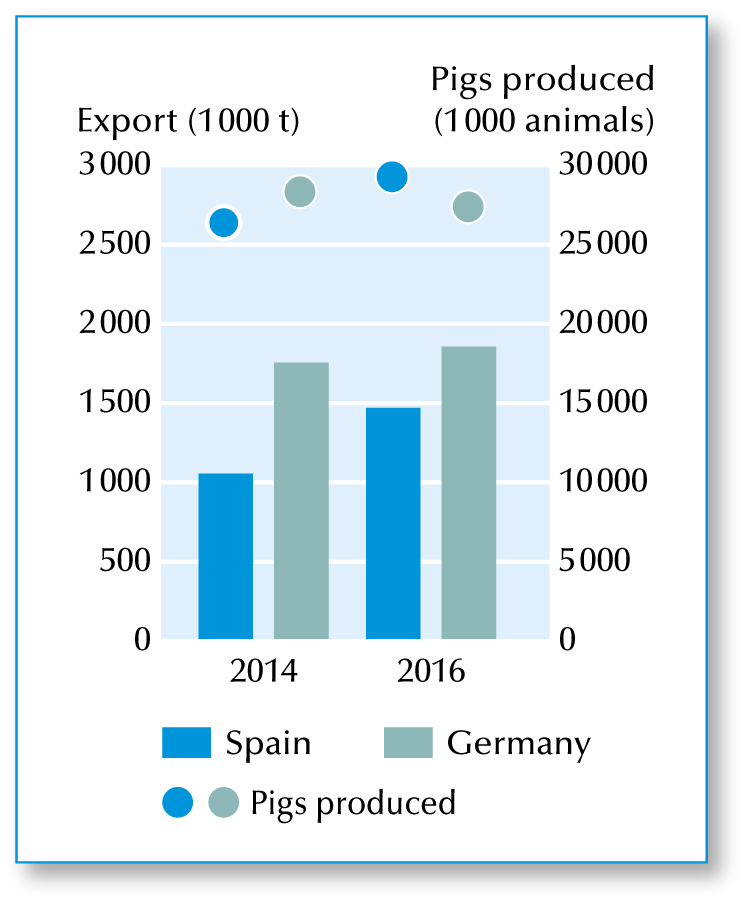

In the last five years Spain bucked the European trend by continuing to expand its pig production. In fact, since 2015 it has the largest pig sector in Europe. Its exports of pig meat outside the EU have also increased – maintaining its high export sales to third countries even in 2017 when China drastically cut its pig meat imports. Germany, the Netherlands and Denmark lost out. In the first half of 2017 their third country sales dropped by around 24.9 or 19% compared with the same period of the previous year. With that, Spain is now the third largest exporter of pig meat worldwide after the USA and Germany. And the sector represents one of the most important export branches in the Spanish economy.

A special role in this success story appears to be played by one characteristic of Spain’s swine sector: the high degree of vertical integration. Some 65% of all pig meat is produced from the integrated chain. Cooperative societies supply a further 18%, with just a little more than 15% of slaughter pig production by »free« farmers producing independently of such organisations.

Four reasons for the success of Spanish pig production

- Intensive integration within Spanish pig meat production has historical grounds and seems the main reason for the sector’s rapid expansion.

- Increasing professionalisation within the entire integration chain over the last 15 years has led to substantial efficiency increases.

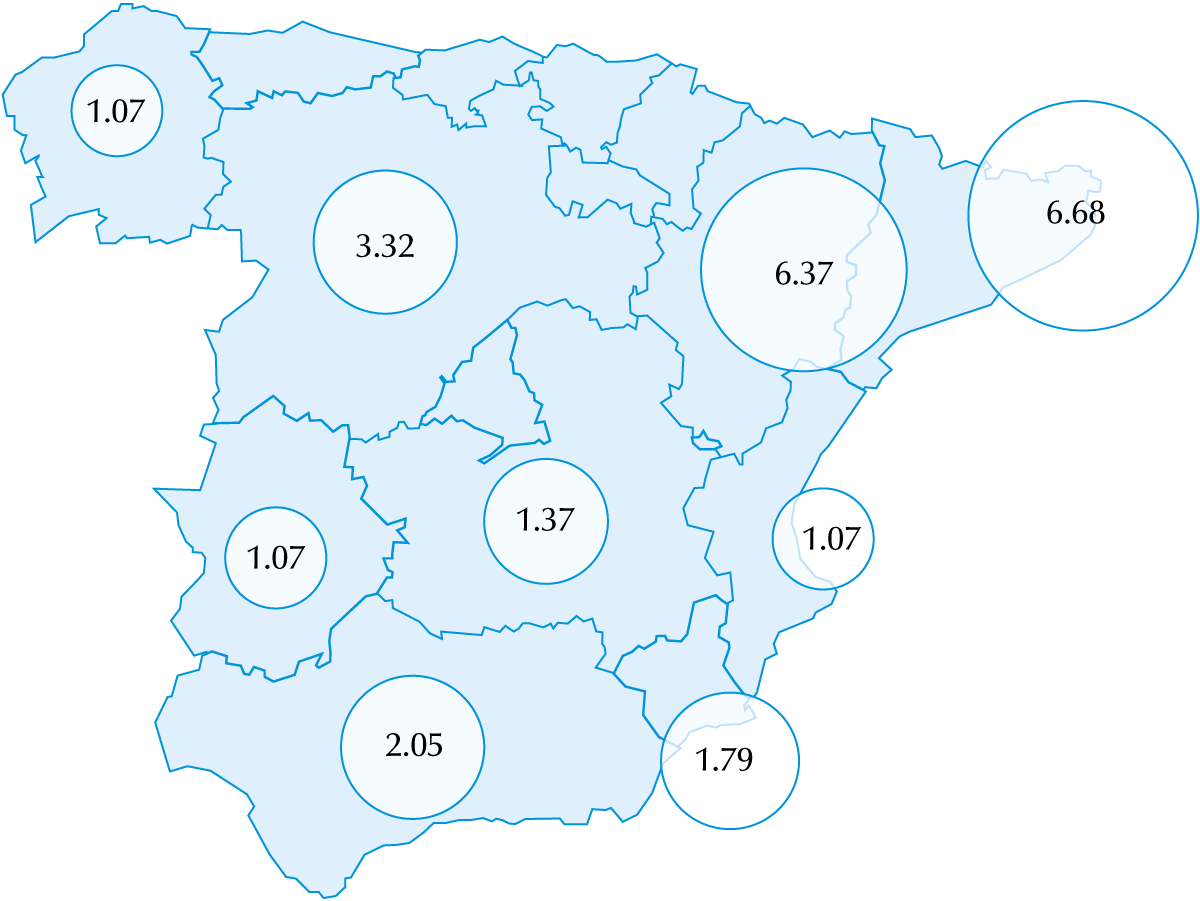

- There exist regions with low population and livestock density where pig production can develop without hindrance. This development is precisely managed by government.

- Regulations for maximum pig unit size and minimum distance between farms create herd hygiene advantages as well as encouraging a high degree of public acceptance.

How does integration work in Spain?

Most integrated organisations have their beginnings in the feed business. They own the animals, produce and supply the feed, supply veterinary input (including medicinal costs) and management advisory services. The farmer is responsible for labour inputs, building and energy costs and manure management. Many integrators also have their own slaughterhouse. With that, the respective organisations control the entire production chain. Long-term (two to five years) contracts are signed between farmers and integrators with agreements on piglet, or slaughter pig, production.

Why swap independence for integration?

The most important reasons: straightforward calculations and security for future costs and income, according to Pablo Bernardos Hernández, pig meat department manager in the Spanish Ministry of Agriculture. Not that there are many alternatives available. Still, for a »free« weaner producer in Spain, as in other EU countries, giving up business independence in return for a secure income from buildings and labour doesn’t always have to be negative under Spanish conditions, says a piglet producer. »Pigs from non-integrated farms represent only a fraction of total national production. This means free producers can be at a pricing disadvantage. Particularly as a piglet producer, there are very few market options.« One result is that increasing numbers of free producers bind themselves to integrators by agreeing delivery contracts. This also helps integrators to cover deficits in piglet supply.

These free piglet producers have no guarantee their contract will be renewed. Then again, neither do the permanently integrated farmers have a guarantee. A contract might not be renewed, for instance, if a farm has not expanded enough where growth in output is needed for increasing efficiency within the integrator organisation.

This production method has historical grounds

Despite the cost advantages offered, the vertical chain has failed to establish itself in other large-scale production EU countries. The background is that Spain was a late starter in expanding production capacity. The Franco regime ensured that until 1975 the country was more or less isolated from the rest of Europe. Livestock production didn’t expand as in other western lands because Spain missed out on the Marshall Plan which encouraged livestock output in western Europe where the post-war drift from land to cities meant a rise in demand for shop-bought foods.

This poor relationship to the rest of Europe led Spain to turn more to the USA, orienting meat production on integrated models that already dominated in the ‘States, having been initiated in the poultry sector. Integrated systems were then also introduced in the pig sector. Spanish feed production firms, especially those in Catalonia, copied the idea. Contract agreements between feed firms and pig farmers were the basis of the first integrations.

Prices can be calculated

Regular slumps in pig prices led to increasing numbers of pig producers turning to integration. Degree of integration continued to intensify. Companies involved became ever more industrialised and added to their chains with piglet production, slaughtering, cutting and processing – and export. The concept of entire chain integration meant more attention being paid to piglet supply. This was expanded by the firms in Spain so that dependence on piglet imports became less.

Spain’s natural competitive disadvantage, feed costs and dependency on grain imports, also made integration more attractive. To be more competitive at European level, costs had to be reduced. This proved possible through feed producers generating more turnover through contractual agreements. Integration also saved costs by offering efficiency improvements within the production chain.

Spain has become a leader in pig meat output

The result is that Spain has developed from a pig meat importer to a global player. According to USDA estimates, the Spanish pig sector is one of the most efficient in the EU. The price crisis initiated by the Russian import embargo saw Spain surviving better than its European neighbours. While EU exports in 2014 dropped by 2%, the Spanish shipments increased by 7.5%.

Through committed international orientation, ably supported by the Spanish government, exports have been rapidly increased, meeting a rising demand in Asia. The Chinese market saw Spain appearing one year before the rest of the EU, mainly because Spain suffered from the Russian embargo 12 months earlier that its European neighbours further north. This strategic advantage was exploited through Spain swiftly presenting a quality image for its pig meat in Asia.

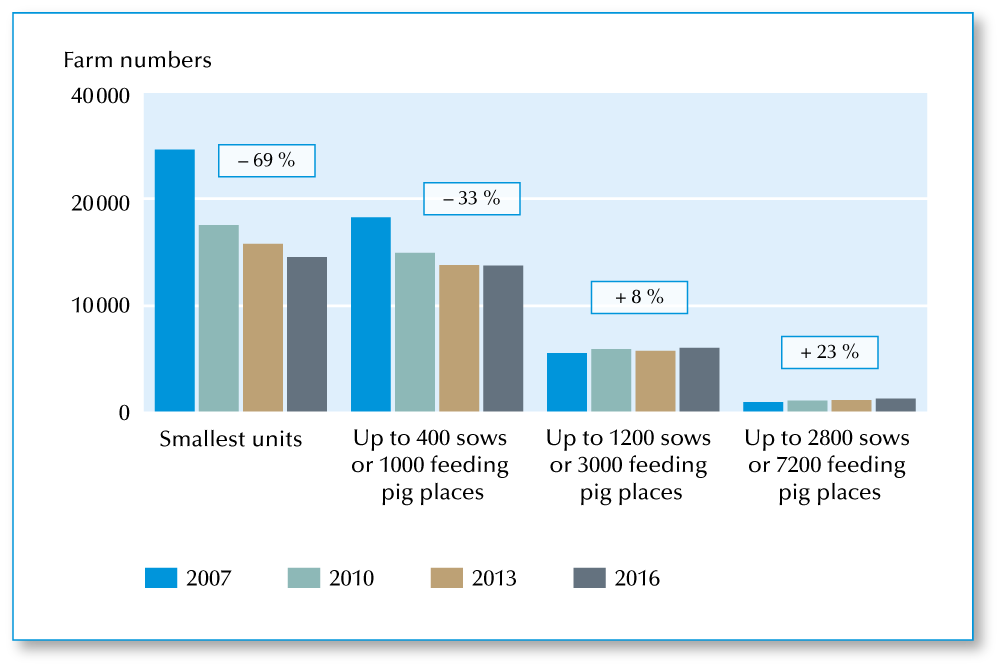

Structural change to larger farms continues

For years now, the restructuring of production capacities from many smaller and mid-sized farms to fewer but larger ones (graph 3) has continued in Spain. As everywhere, the structure change is encouraged by legislation on livestock and environmental protection. The high degree of integration also aids the change to larger, more efficient, structures. In 2000, the Spanish government rejected the concept of even more concentration in this region. Since then, a law has been passed that determines a minimum distance between pig production units and also regulates their maximum size. In practice, this means that not more than 2880 sows (or 900 sows in farrow-to-slaughter systems), or 7200 feeding pigs are allowed on one site. Where new pig buildings are built, the minimum distance is between 500 m and 3 km, depending on size and type of production.

At that time, the background to the restrictions was fear of animal disease spread. The important export sector had to be protected. But these laws have also contributed to acceptance by the Spanish public of intensive pig production. The main pig region in the northeast has been pushed westwards by these regulations, into areas not only of low pig density but also featuring only scattered human settlements in a country that already has a much lower average population density than much of West Europe. The development has meant less opportunity for humans and pig production to clash.

The state supports pig sector development

Madrid helps here because it wants to see the sector’s development continuing. Bernardos Hernández explains: »The legislation is already old. Currently, an overhaul with an eye on environmental protection is underway. This is actually because of EU legislation: the requirement to reduce ammonia emissions affecting the pig sector too.« After all, higher environmental protection requirements are closely associated with acceptance of the branch by the general public. »We can further increase our production because we still have thinly populated regions where there’s room for pig production units without negative influence on human settlements«, says Bernardos Hernández. This balancing act between reducing emissions and increasing production can be managed with technology, he feels. Ammonia emissions can be substantially reduced with reasonable economic outlay through improved application methods and working the manure into the soil. Bernardos Hernández reckons, however, that farmers will not be able to avoid these so far voluntary production-technological measures becoming mandatory.

Less strict controls in Spain? Is it really so?

The enormous development of Spanish pig production is often explained by other nationalities as through Spanish farmers having less strict regulations in livestock and environment protection imposed on them. Reacting to this criticism, a piglet producer in Catalonia says: »In Spain, too, the loose housing of sows in groups is mandatory. And the farms are inspected.« However, he adds that there is indeed one difference: »The people applying the rules in Germany are basically critical of pig production. In Spain, production is better accepted and no obstacles are put in the way of farmers.« And the single point of Spain having land available for expansion of pig production means it is relatively easy to get planning and building permission. Resistance from the public against building livestock housing just doesn’t happen. »However, even with no public debates against livestock farming, the general awareness of intensive livestock production continually increases«, explains Bernardos Hernández. And this has led to a marked increase in legislation touching on the areas of animal health, livestock and environment protection.