Six maps explain the world markets

By Dr Christian Bickert

Output of agricultural products and their trade steams on the world markets appear at first complex and hard to follow. But global trade patterns tend to repeat themselves and follow fixed rules. Those who understand this can then appreciate many developments or even anticipate them.

Barley: An EU speciality

Regarding cereal crops grown in the EU, the most Important overall is barley. Almost 45 % of worldwide barley grows on EU fields and in terms of global exports one fifth of this grain is from our economic area, In some years even a quarter. Main customers are Saudi Arabia and China, most of the rest distributed between North African and Near East countries. Less than 10 % of globally traded barley goes to Japan and (especially brewing malt) South American countries. Important competitors for the EU in this export market number only three: Russia, Ukraine and Australia. All play more or less in the same league as we do, selling, depending on the year, between 4 and 6 million tonnes (m t) abroad. Taking Canada, Argentina and Kazakhstan together, the three have around the same importance on the barley market as just one of the big four. Interesting is that wherever barley Is grown, the climatic risks are very high. This also applies to parts of the EU. After all, the very constant yields In Germany, for Instance, stand alongside the huge variations possible in Spain. A special competitor for the barley crop is maize which repeatedly replaces the cereal grain as feed ingredient.

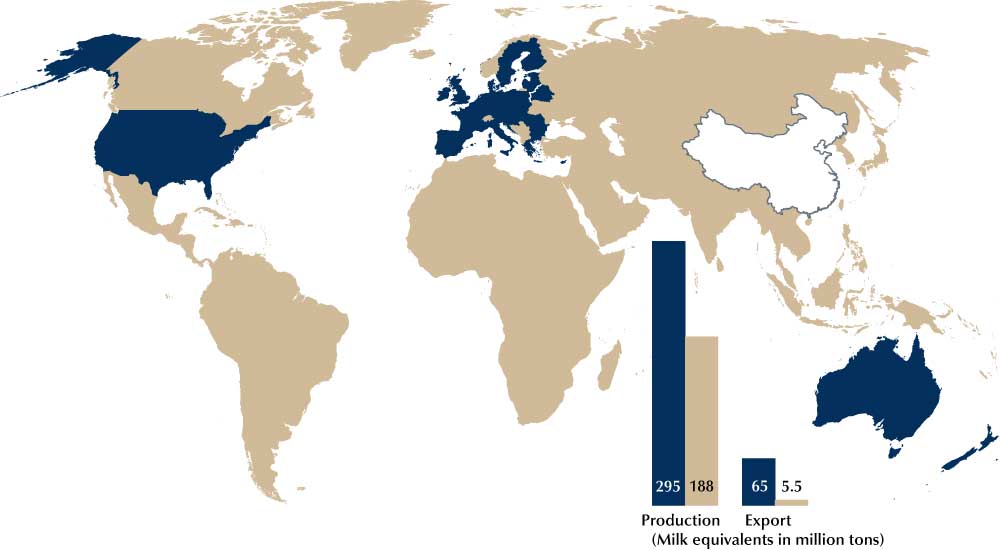

Milk: Five players share the world market

Milk and its products are consumed everywhere. But not every country plays a role in the market. India, for instance, doesn't – and It is the second-largest milk producing land (80 m t). In only a very few countries is there milk overproduction large enough for a permanent export trade (mainly as whole milk powder). Battling for first place in worldwide dairy exports are New Zealand and the EU. And well above the rest in third position here Is the USA.

But would you have thought of Belarus as the fourth largest in this category, edging into the line-up before even Australia? The largest importer (how could it be otherwise?) is China, buying mostly milk powder. For production, weather plays an important role only in Australia and New Zealand where droughts can regularly reduce milk output. In the other important countries, (out in the wings, Canada and Argentina also play a small role), feed costs (USA) or politics (EU) affect the amount of milk produced and, therefore, its price.

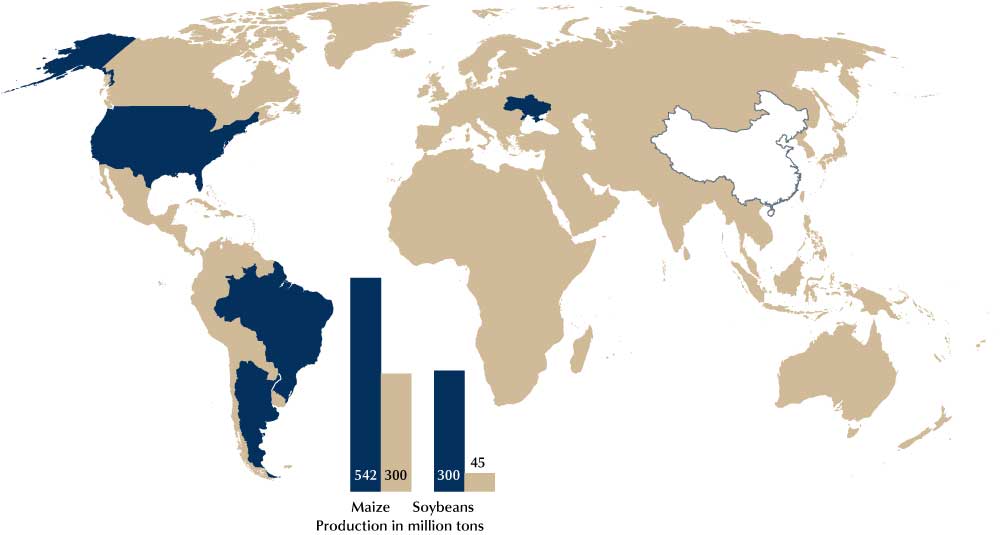

Soya and maize: Almost all from the Americas

Soybeans and maize represent very simple crops. And just as straightforward is structure of the important market factors. If the harvests perform well in North and South America, then there's oversupply. If the weather goes crazy in one of the areas, great holes can be torn in global supply. In addition to the three largest producers of soybeans the only other country playing a role in trading is Paraguay. For this reason, every dry spell in the USA or South America, even comparatively small area droughts (and definitely every fully-fledged one) is subject to intense analysis in all marketing news. In terms of demand for soybeans, China is important. The rise of soya production in the Americas was reflected 1:1 in the increase in consumption In China. But this situation appears for the moment to have ended. Not only because of the ongoing US-China trade crisis, but also through the effects of swine fever.

In maize, the USA dominates the global market. 40 % of all maize exports worldwide come from there. Brazil, Argentina and, for the last few years, Ukraine too, together deliver another good 40 %. Ukraine Is especially important for us in the EU because it produces GM-free maize. China is the second largest grower of the crop, the EU landing on place 4. Only as importers do both play a role, China a relatively unimportant one, shipping-In approx. 5 m t and the EU having the biggest demand currently. Normally, though, we occupy place 3 in the import league. In that the demand (with the exception of the EU In the present year) is relatively constant, price is determined by supply and therefore by the weather in the Americas.

For nearly all farm products China is among the largest producers, although the country plays hardly any role in the world market as exporter. And no one can really say just how high Chinese production is, or how much product lies in store. This means China has a potential for distorting the world trade maps and this is why we omit the country from the graphs and figures here.

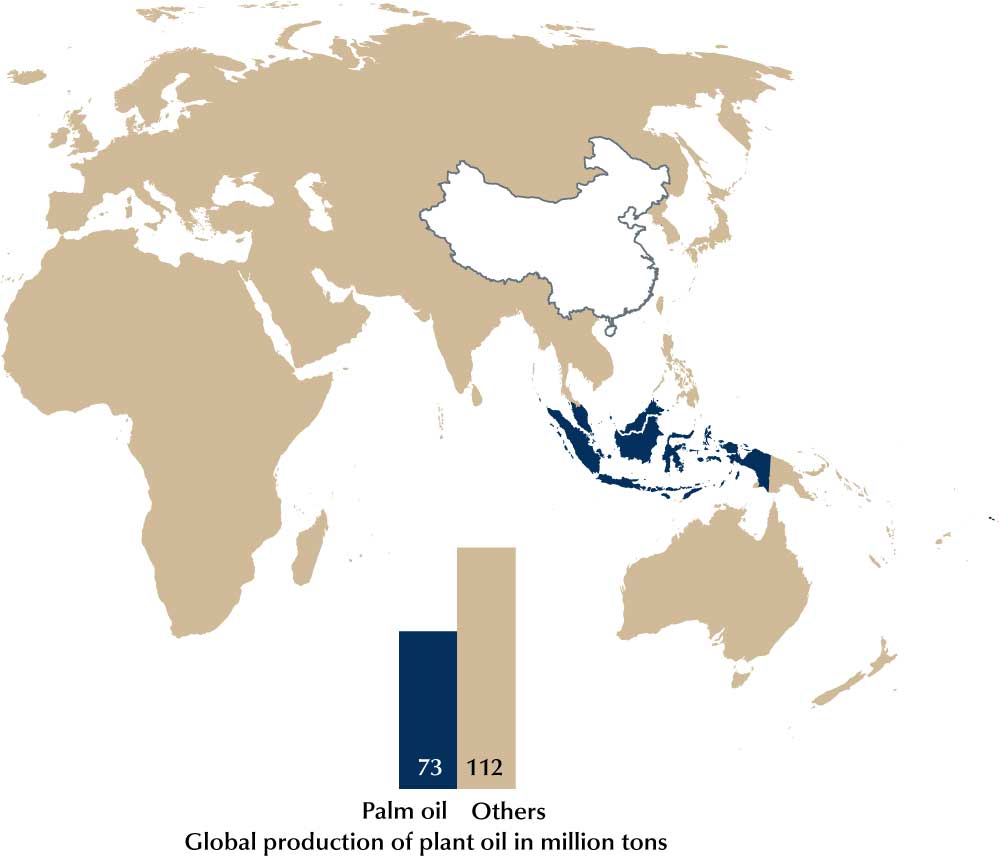

Palm oil: Plant oil price is made in Southeast Asia

Indonesia and Malaysia: from these two nations flows over 85 % of the worldwide palm oil harvest. And because palm oil represents a little over one third of global plant oil production, the price level of our rapeseed, too, is determined in the end by the harvest in these two countries, although soybean supply has a leading function in rapeseed meal pricing, and soya oil is itself not entirely unimportant in this respect. However, if rapeseed tends towards 350 €/t or 500 €/t, this depends less on the rapeseed harvest in the EU and much more on the price of palm oil.

The amount of palm oil that comes onto the world market depends mainly on rainfall levels. When the forests were burning in Malaysia in 2014, the palm oil harvest 18 months later on slumped. One-and-a-half years: this is the time lag between a weather event and its effect on the palm oil harvest. Currently, rainfall in Southeast Asia is good, so that up to the end of 2020 no harvest fallout is expected.

Bad news for European oilseed rape.

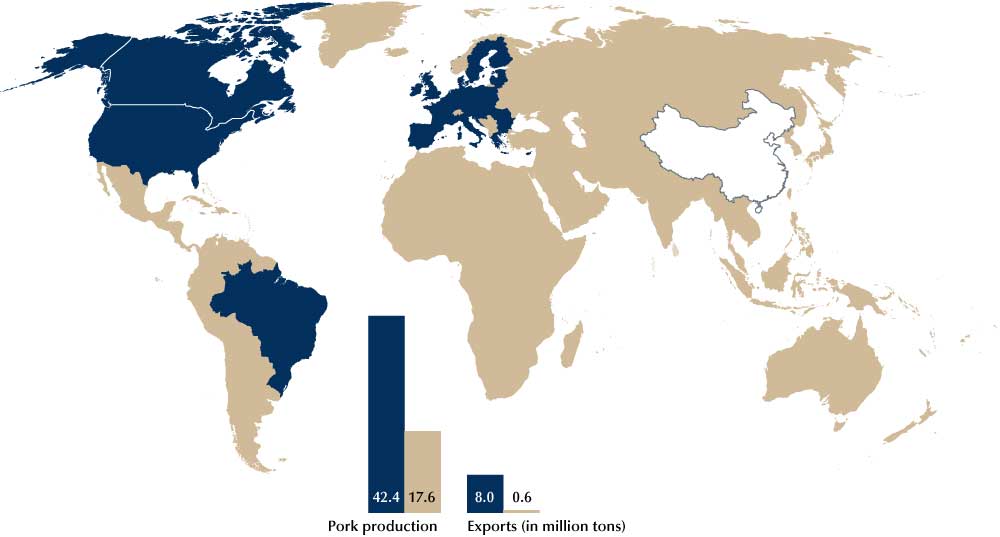

Pig meat – the West produces, Asia buys

There is no other food or agricultural product that has its statistics more distorted by China than pig meat. Every second pig in the world lives in China. Half of all pig meat is produced – and consumed – there. At the same time, China is a leading importer. And this could change dramatically this year, if the African swine fever outbreak there should spread still further.

Outside China, 60 % of the pig population is in the USA and EU. If Brazil and Canada are added, then 70 % is the figure. Even more emphatic are the world trade figures: 5.8 m t, or 68 %, of total pig meat produced is exported from the EU and USA, add exports from Brazil and Canada and the figure is 92 %. Thus, feed costs and disease have very decisive influences on market shares.

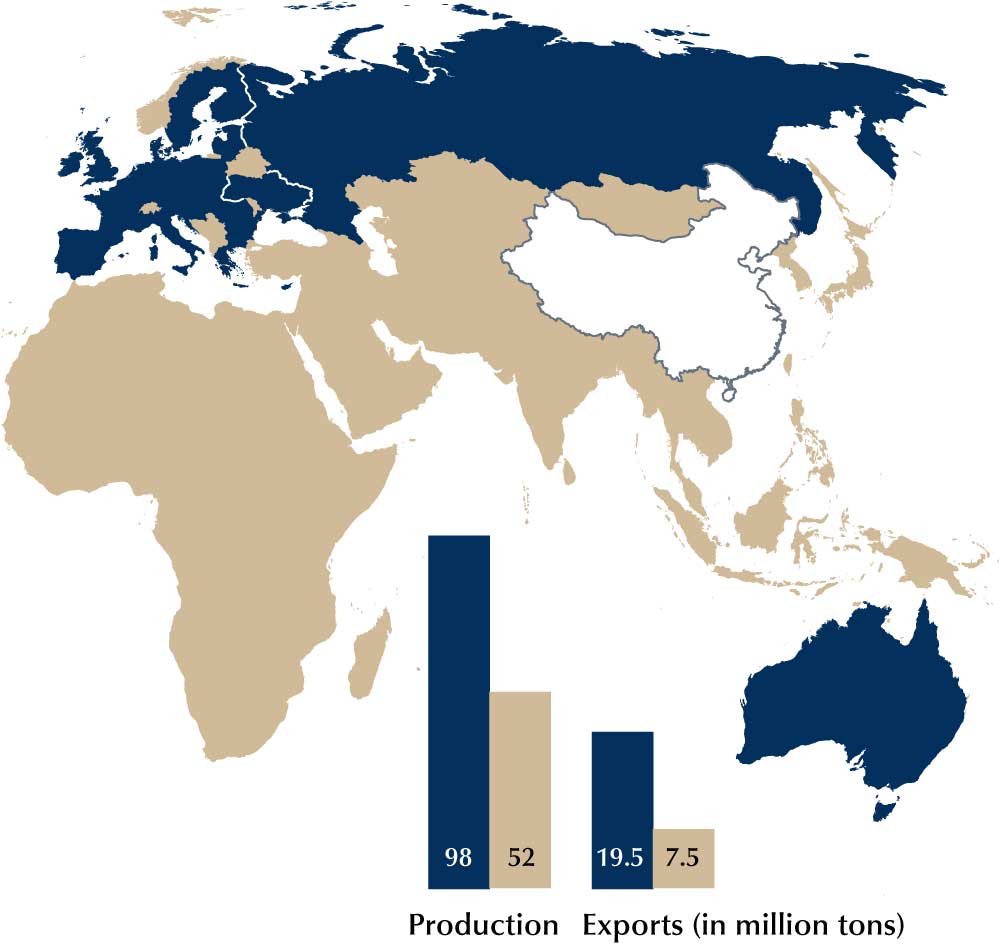

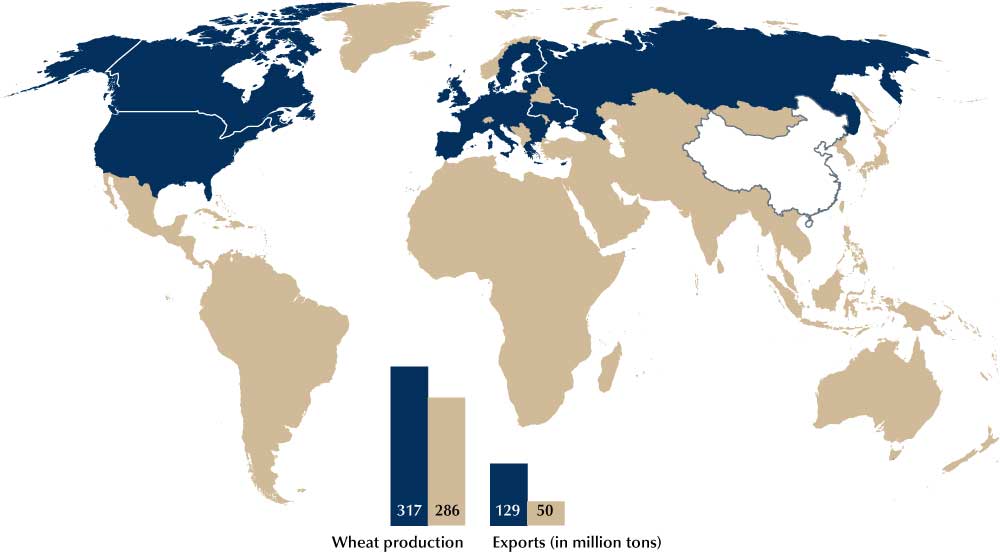

Wheat – between the Black Sea and the Chicago Exchange

Wheat is not the only pivotal point for all agricultural prices. But it's the most important one. Whether as important component in feed, as calculation factor for maize price at field gate, as basis for sugar beet price or also as fundament for farmland rent – the price of wheat determines a substantial proportion of price levels in the agricultural world of many countries.

For years now, top European producing countries, or at any rate the EU, helped determined the pattern followed on the world market. Only three years ago, one fifth of worldwide wheat deliveries (35 m t) was shipped out of EU harbours. In the meantime, the picture has turned around, even without considering the effects of the poor harvests suffered in the last years. The Black Sea harbours (an important one also lies in EU member country Romania) now ship out one third of all world wheat exports. In the last two years, only around 25 m t came out of the EU, during the present year, less than 20 m t, a figure the EU Commission now reduces to just 18 m t.

Wheat is a product of the northern hemisphere. South of the equator only Australia and Argentina cart home harvests of any note, although what they both produce only matches the tonnage that Russia exports annually. The two largest wheat producing countries in the world also play no role in global trading: China with a harvest of 130 m t and India with 100 m t production. These two lands are completely focussed on their respective domestic needs and only once in a while India attracts attention with smaller exports or imports.

Decisive for prices everywhere are mainly the harvests in eastern Europe - and the Board of Trade Exchange In Chicago. There, the yardsticks for wheat, maize and soya price developments are set up. And what do the dealers in Chicago do before business begins? They look at the weather, and its possible Influence on exports from Russia or Ukraine. Only after that do cold snaps in Canada, or maybe drought in the EU, play a role.