Securing profitability a central topic for Thai farmers

Sixty-seven percent of the cash crop producers surveyed in Thailand intend to invest in the coming 12 months. Thailand's farmers therefore hold the top position among the countries surveyed and demonstrate a considerably higher investment confidence than in Brazil, Zambia and South Africa. Within Thailand cash crop producers display the greatest investment confidence among those surveyed. Almost three-quarters of the cash crop producers surveyed are planning investments in the coming 12 months.

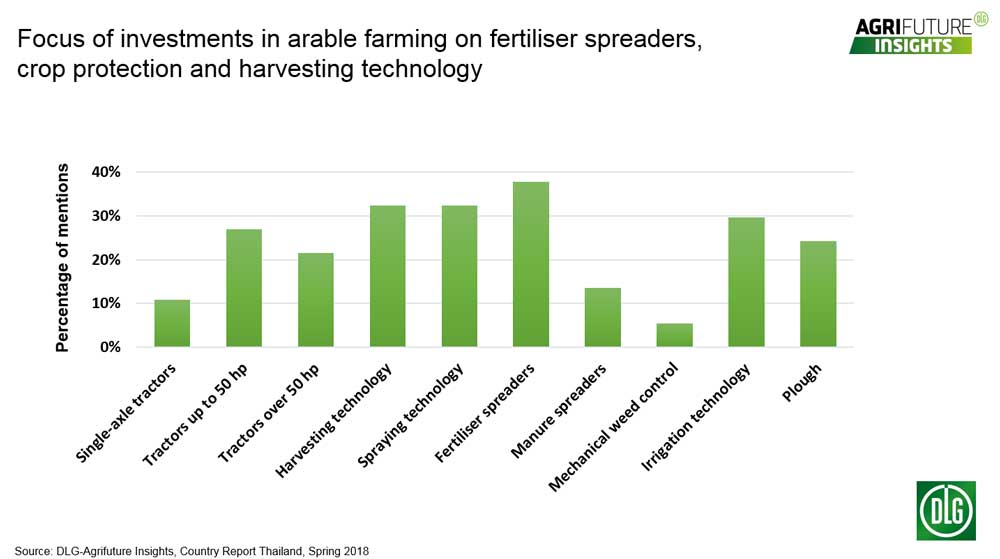

The focus of investments lies primarily on fertilising technology. 38 percent of the cash crop producers surveyed are planning to purchase new fertiliser spreaders in the coming 12 months. Additional investments focus on crop protection and harvesting technology. Just under 30 percent of the surveyed cash crop producers intend to invest in irrigation technology. The drought which has also occurred this year due to a lack of precipitation leads to a noticeable decrease in the most important Thai crops, such as rice and sugar, and clearly shows the challenges of a sufficient water supply for crops.

For investments in tractors, small tractors up to 50 hp play the greatest role. One fifth of the arable farmers surveyed are investing in the tractor size class above 50 hp and are becoming mechanised with larger technology compared to other countries. The farm managers surveyed are planning to invest less in the areas of single-axle tractors (with eleven percent). The arable farmers surveyed are investing in tractor-based mechanisation and are therefore realising the next level of mechanisation.

Purchasing decision for agricultural technology: Durability and manufacturer most important criteria

The cash crop produces surveyed intend to modernise ongoing production with their investments in order to strengthen their competitiveness and efficiency with higher productivity. For most farmers (80 percent) the durability of machines is the most important purchasing criterion when making a purchasing decision. For durable machines are reliable and reduce repairs which are often tied to high logistical effort and lead to long downtimes of the machines.

With 70 percent, the manufacturer also plays a major role for the purchasing decision. For manufacturers' names are linked to product properties and affect the purchasing decision. The purchase price and the prices for spare parts follow in third place. The economic efficiency of production plays an increasing role among market-oriented farmers, which is why farm managers include machine and maintenance costs in their investment decisions.

DLG-Agrifuture Insights

DLG-Agrifuture Insights is the new DLG knowledge brand and platform for international trend analyses in the agricultural sector. It examines the business environment in agriculture and agricultural business with a global panel of 2,000 leading farmers in 13 countries. Each month Agrifuture Insights will publish a "Graphic of the month" from the extensive range of development trends on the international agricultural markets.

Interested persons can obtain additional information on DLG-Agrifuture Insights from the DLG. The contact is Dr. Achim Schaffner, Head of the Economy Department, Tel.: 069/24788-321 or e-mail: afi@dlg.org. Information is also available at www.DLG.org/afi.