Willingness to invest over the next twelve months

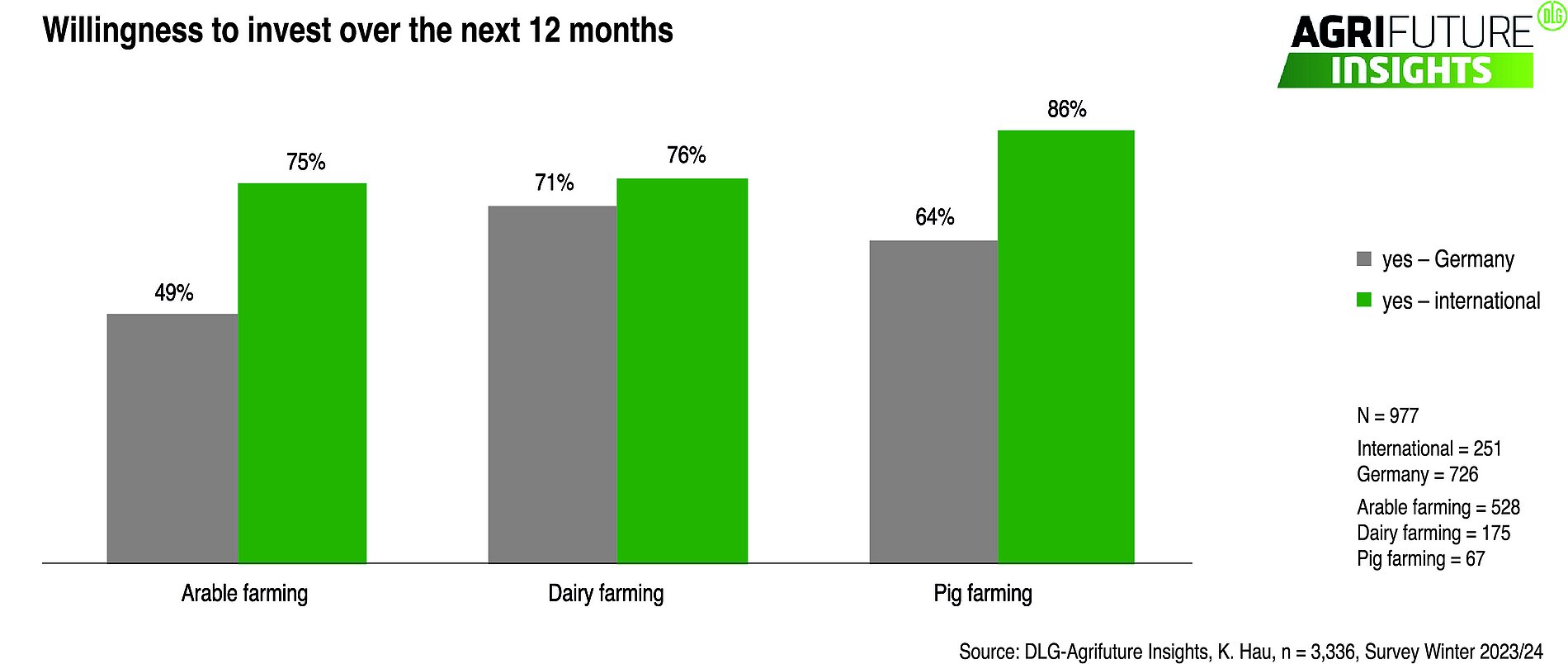

Who wants to invest and who is holding back? In the latest "Chart of the Month" from DLG-Agrifuture Insights, the plans of German arable farmers, dairy farmers and pig farmers with those of their international colleagues are compared.

As part of the current Agrifuture Insights study from November 2023 to the beginning of January 2024, farmers in Germany and abroad were asked about their investment plans for the next twelve months. In an international comparison, German arable farmers, dairy farmers and pig farmers are significantly more cautious than their foreign counterparts.

Chart of the Month

Willingness to invest over the next twelve months

The sharp rise in interest rates and high acquisition costs, in particular in Germany, are likely to be an important factor for farm managers when deciding whether to invest. A lack of planning security and high bureaucratic hurdles are further obstacles.

Last year, many arable farmers took the opportunity to reinvest the profits made from high producer prices. The agricultural machinery industry achieved record results. This is probably one of the reasons why 59% of arable farmers surveyed in Germany are planning fewer investments this year than in the previous year (64%).

Pig farmers, on the other hand, are in a more positive mood. Compared to the previous year, they are showing an increase in willingness to invest both in Germany and internationally. Last year, they were able to make profits again for the first time, which they can reinvest. In addition, the current outlook for pig prices in 2024 is positive.

Pig farmers willing to invest are primarily planning to invest in improving energy efficiency (35%) in the area of emissions and climate impact and in the area of animal welfare and animal health in the conversion of the breeding center (29%) and in employment opportunities (28%).

The smallest difference in willingness to invest can be seen between German and international dairy farmers. Here, the focus is on optimized feeding (47%), manure treatment, storage and spreading (40%) and optimizing barn equipment. At the top of the list of planned investments within stables (40%) are, for example, comfort mattresses or rubber flooring on walkways.

DLG-Agrifuture Insights – a comprehensive view on agricultural development

DLG-Agrifuture Insights is the DLG knowledge brand and platform for international trend analyses in the agricultural sector. It examines the business environment in agriculture in Germany and worldwide. For this purpose, farmers and people from agribusiness, science and consulting are surveyed annually on their assessments of the economic situation and development of agricultural businesses, as well as technology trends and innovations in the individual business sectors. A total of 3,336 people took part in the current survey in winter 2023/24, around 1,300 of them from abroad.